As a leading “Buy Now, Pay Later” (BNPL) service, Zilch offers UK consumers a flexible way to manage their finances. However, its potential to influence credit scores has sparked much discussion.

By understanding Zilch’s features and services, users can determine its suitability for building their financial reputation. This blog does zilch improve credit score will provide an in-depth look at how Zilch works, its credit-building capabilities, and essential tips for responsible use.

What is Zilch?

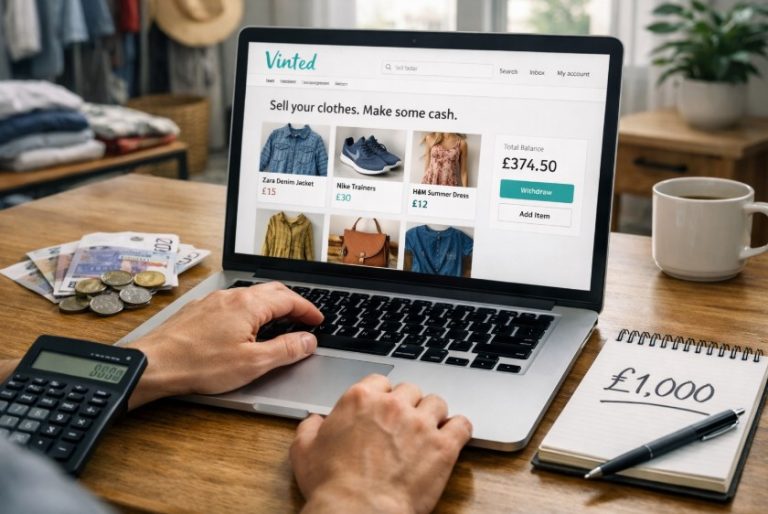

Zilch is a cutting-edge “Buy Now, Pay Later” (BNPL) platform that allows consumers to shop and pay in instalments without the typical drawbacks of traditional credit options.

Unlike credit cards, which often carry high-interest rates and hidden fees, Zilch provides a transparent and flexible payment system designed to suit modern financial needs.

Zilch operates as a hybrid payment solution, blending the convenience of BNPL services with the opportunity to build and maintain a healthy credit score.

The platform offers both interest-free payment options for quick repayments and low-interest plans for longer durations, giving users the freedom to choose how they manage their finances.

Key Features of Zilch

- Interest-Free Payments: Pay over six weeks with no interest when payments are made on time.

- Low-Interest Plans: Longer repayment options with competitive APR rates, such as 18.6% for the Zilch Classic card.

- Wide Accessibility: Shop both online and in-store at thousands of partner businesses.

- Zilch Rewards: Earn cashback and discounts on purchases.

- Tailored Credit Options: Different cards (Zilch Up, Zilch Classic, Zilch X) to suit various financial profiles.

By offering these features, Zilch not only helps users manage their finances but also positions itself as a tool for improving credit scores—a rarity in the BNPL space.

How Does Zilch Work?

Zilch is designed for ease of use, allowing users to quickly set up and start enjoying its benefits. Here’s a detailed explanation of how it operates:

Getting Started

- Download the App: The Zilch app is available on both Android and iOS platforms.

- Create an Account: Sign up with basic details and a soft credit check to assess eligibility (this does not impact your credit score).

- Verify Identity: Complete a quick verification process to ensure secure and personalised services.

Payment Options

Zilch provides users with flexible payment methods:

- Interest-Free Payments: Split the total amount into four instalments over six weeks.

- Longer Repayment Plans: Opt for up to three months of repayment with a low APR rate.

Using Zilch

- In-Store Purchases: Use the Zilch virtual card linked to your account for contactless payments.

- Online Shopping: Integrate Zilch at checkout with partner retailers or use the virtual card for payments anywhere.

- Zilch Rewards: Earn cashback and discounts that can be redeemed on future purchases.

Responsible Credit Building

- Through the Zilch Up Programme, users can improve their credit score by making consistent, on-time payments.

- By reporting activity to credit reference agencies, Zilch transforms typical BNPL usage into a credit-building opportunity.

Zilch Cards: Tailored for Everyone

Zilch offers multiple card options to meet the needs of different customers:

Zilch Up

Designed for those focused on credit building, Zilch Up offers up to £600 with a 25.2% APR Representative. This option helps users build a positive credit history by making on-time payments.

- Credit subject to status.

- Terms and conditions apply.

Zilch Classic

Aimed at users seeking greater flexibility, Zilch Classic provides up to £2250 with an 18.6% APR Representative. This card is ideal for managing larger purchases responsibly.

- Credit subject to status.

- Terms and conditions apply.

Zilch X (Coming Soon)

For those who desire extra benefits, Zilch X offers up to £2250 with a lower 14.99% APR Representative. It is expected to bring enhanced features for premium users.

- Credit subject to status.

- Terms and conditions apply.

Each card provides unique benefits, allowing users to choose the one best suited to their financial requirements.

The Role of Credit Scores

A credit score represents a consumer’s financial reliability and affects their ability to access loans, mortgages, and other credit products. Key components of credit scores include:

- Payment History: It’s critical to always pay bills on time.

- Credit Utilisation: Using credit responsibly without maxing out limits.

- Length of Credit History: Establishing a history of responsible credit use.

Representative Example for Zilch Payments

Zilch offers competitive APR rates for its services. Here’s a representative example for a typical Zilch transaction:

- Representative APR: 18.6%.

- Example Transaction: Total spend of £495 (+£5.30 fees).

- Repayment Terms: Total repayable £500.30 over six weeks or three months.

- 1st payment: £129.05.

- 3 subsequent payments of £123.75.

- Reminder: Spending more than you can afford could seriously impact your financial status. Credit is subject to status and available to UK residents aged 18 or older. Terms and conditions apply.

Does Zilch Improve Credit Score?

The answer is Yes—Zilch can improve your credit score if used responsibly. However, there are situations where the answer could be No if poor financial habits come into play. Let’s delve deeper into how Zilch impacts credit scores and the factors that influence its effectiveness.

How Zilch Can Positively Impact Your Credit Score?

Credit Reporting to Agencies

- Zilch is one of the few “Buy Now, Pay Later” platforms that actively reports user activity to major UK credit reference agencies like Experian and Equifax.

- This means that your responsible use of Zilch—making payments on time, managing credit limits, and avoiding defaults—can contribute positively to your credit profile.

Building a Strong Payment History

- About one-third of your credit score is based on your payment history. By consistently paying Zilch instalments on or before the due date, you establish a track record of financial reliability.

- Over time, this strengthens your creditworthiness in the eyes of lenders.

Zilch Up Programme

- Zilch Up is specifically designed for users who want to improve their credit scores. It offers a manageable credit limit of up to £600, encouraging users to build credit in a controlled manner.

- By maintaining regular and timely payments under this programme, users can gradually enhance their credit score without overwhelming their finances.

Soft Credit Checks

- When you sign up for Zilch, the platform performs a soft credit check to assess eligibility. This type of check does not affect your credit score, making it a low-risk way to explore the service.

- As you continue to use Zilch and build a payment history, the soft check transitions into a positive contribution to your credit profile.

Transparent Financial Management

- Zilch promotes responsible spending through its clear repayment terms and fees.

- Users are encouraged to choose payment plans that fit their financial capabilities, ensuring they maintain a healthy credit profile while enjoying the benefits of flexible payments.

When Zilch Won’t Improve Your Credit Score?

While Zilch has the potential to improve your credit score, No, it won’t help if certain risks are not managed. Below are scenarios where Zilch might negatively impact your credit score:

Missed or Late Payments

- If you fail to make payments on time, Zilch reports this to credit reference agencies. Late or missed payments damage your payment history, which is a critical factor in your credit score.

- This can make it harder for you to access loans, mortgages, or other forms of credit in the future.

Overborrowing and Debt Accumulation

- Using Zilch excessively without a clear repayment plan can lead to financial strain.

- Overborrowing may increase your credit utilisation ratio (the amount of credit used compared to the credit available), which can harm your credit score.

Irresponsible Spending

- Spending more than you can afford, even with Zilch’s flexible repayment plans, can create a cycle of debt.

- This could lead to defaults, negatively impacting your credit profile.

Limited Impact Without Reporting

- While Zilch reports to major credit agencies, it’s essential to confirm that your specific activities are being recorded.

- If Zilch doesn’t report certain payment histories, the impact on your credit score could be minimal.

Tips for Using Zilch to Improve Your Credit Score

To maximise the benefits of Zilch while minimising risks, follow these best practices:

- Set Payment Reminders: Use calendar alerts or notifications to ensure you never miss a payment.

- Stick to a Budget: Use Zilch only for planned purchases and avoid unnecessary spending.

- Monitor Your Credit Report: Regularly check your credit report with agencies like Experian, Equifax, or TransUnion to track improvements.

- Use Zilch Up: Focus on Zilch’s credit-building programme to make manageable payments that positively contribute to your score.

- Avoid Overreliance: Treat Zilch as one of several tools for managing your finances rather than your primary credit source.

Comparing Zilch to Other BNPL Platforms

As the “Buy Now, Pay Later” (BNPL) industry continues to expand, consumers have numerous options to choose from, each with unique features and benefits.

Zilch stands out in several ways, especially when it comes to credit building and financial transparency. Let’s examine how Zilch compares to other major BNPL platforms in the market.

Credit Reporting

One of Zilch’s standout features is its commitment to reporting user payment activity to major credit reference agencies.

- Zilch: Reports positive payment activity to agencies like Experian and Equifax, helping users build credit.

- Other BNPL Platforms: Most competitors, such as Klarna and Clearpay, do not actively report to credit agencies. This limits their ability to help users establish or improve their credit scores.

- Advantage: For consumers looking to improve their financial standing, Zilch provides a unique opportunity compared to competitors.

Payment Flexibility

BNPL platforms are known for their flexible payment options, but Zilch takes it a step further by offering multiple repayment structures:

- Zilch: Offers interest-free payments over six weeks for short-term plans and competitive APRs (e.g., 18.6% Representative for Zilch Classic) for longer-term payments. Users can also choose from various card options tailored to their needs.

- Klarna: Provides three instalments over six weeks (interest-free) or longer-term options with higher APRs.

- Clearpay (Afterpay): Focuses on short-term, interest-free plans but lacks longer-term options with competitive interest rates.

- Laybuy: Allows six weekly payments but charges late fees, which can add up for users who miss instalments.

- Advantage: Zilch’s combination of short- and long-term options, paired with transparent fees, makes it more versatile for users with varying financial needs.

Transparency and Fees

Hidden fees and unclear terms are common complaints about some BNPL services. Zilch addresses this by being upfront about costs and terms.

- Zilch: Clear disclosure of APR rates, repayment schedules, and potential fees. For instance, an 18.6% APR Representative applies to the Zilch Classic card, and users know exactly what they owe before committing.

- Other BNPL Platforms: Many platforms disclose fees only at the payment stage, leading to confusion and unexpected charges. For example, Clearpay imposes late fees that can significantly increase the cost of purchases.

- Advantage: Zilch’s transparency fosters trust and empowers users to make informed decisions.

Credit-Building Opportunities

For users looking to establish or improve their credit scores, Zilch offers targeted solutions:

- Zilch: The Zilch Up Programme is specifically designed for credit building, with a manageable credit limit of up to £600. Payments made on time positively influence credit scores.

- Other BNPL Platforms: Platforms like Klarna and Clearpay do not offer credit-building programmes, as they primarily target convenience rather than financial growth.

- Advantage: Zilch provides a pathway for users to achieve long-term financial benefits beyond mere convenience.

Availability and Integration

The availability of BNPL services at major retailers and their integration with shopping platforms are key considerations for consumers.

- Zilch: Offers a virtual card that can be used across thousands of online and in-store retailers. Zilch’s app also integrates seamlessly with partner platforms, allowing users to shop wherever they want.

- Klarna: Widely accepted across many online retailers, but not all platforms support it.

- Clearpay and Laybuy: Available at selected retailers, limiting shopping options compared to Zilch.

- Advantage: Zilch’s broader acceptance and versatile virtual card make it a more practical choice for everyday purchases.

APR Rates and Loan Limits

APR rates and borrowing limits vary significantly between BNPL platforms:

Zilch:

- Zilch Up: 25.2% APR Representative, up to £600 limit.

- Zilch Classic: 18.6% APR Representative, up to £2250 limit.

- Zilch X (Coming Soon): 14.99% APR Representative, up to £2250 limit.

Klarna:

- APRs for longer-term financing often exceed 20%, making it more expensive for users who need extended repayment options.

Clearpay:

- Focuses on interest-free payments but lacks longer-term repayment plans.

Advantage:

- Zilch’s competitive APRs and tiered card options make it suitable for a wider range of financial needs.

User Experience and Customer Support

The ease of use and quality of customer support can significantly influence user satisfaction:

- Zilch: Known for its intuitive app, which provides a streamlined shopping experience and detailed payment tracking. The platform also offers robust customer support to address queries and issues promptly.

- Klarna and Clearpay: While these platforms also have user-friendly apps, their customer support often receives mixed reviews, with complaints about delayed responses.

- Advantage: Zilch’s focus on customer service ensures a smoother and more reliable user experience.

Conclusion: Why Choose Zilch?

While other BNPL platforms like Klarna, Clearpay, and Laybuy excel in certain areas, Zilch distinguishes itself with its unique credit-building capabilities, transparent terms, and versatile payment options.

- If your primary goal is convenience, platforms like Klarna may suffice.

- However, if you’re seeking to improve your credit score, enjoy flexible payment terms, and use a service with clear and competitive fees, Zilch is the superior choice.

For UK consumers who value financial growth and responsible spending, Zilch offers a comprehensive solution that goes beyond what most BNPL platforms provide.

FAQs

Does Zilch report to credit reference agencies?

Yes, Zilch reports your payment activity to major credit reference agencies, such as Experian and Equifax, which can help build your credit score.

Can Zilch harm my credit score?

Yes, missed or late payments can negatively impact your credit score as Zilch reports these to credit agencies.

How does Zilch Up help with credit building?

Zilch Up offers a manageable credit limit of up to £600, allowing users to build their credit by making consistent, on-time payments.

What are Zilch’s repayment options?

Zilch provides interest-free payments over six weeks and longer-term repayment plans with competitive APRs, such as 18.6% Representative for Zilch Classic.

How does Zilch differ from other BNPL platforms?

Unlike many BNPL services, Zilch actively reports to credit agencies and offers credit-building programmes, making it ideal for improving credit scores.

Is Zilch available for everyone?

Zilch is available to UK residents aged 18 or older, subject to a soft credit check and identity verification.

Does Zilch charge late fees?

Zilch is transparent about its fees and repayment terms. However, missed payments may result in additional charges and harm your credit score.