Staying mobile is a necessity, not a luxury, for many older people in the UK. For millions aged 70 and over, driving allows them to remain independent, connected, and active.

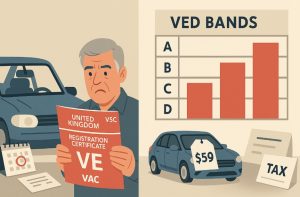

But with sweeping changes to Vehicle Excise Duty (VED) from April 1, 2025, there’s a growing concern that these reforms will disproportionately affect older motorists.

According to recent figures, drivers born between 1946 and 1964, the baby boomer generation, are expected to bear a significant share of the rising tax burden, with a combined annual increase of over £40.5 million.

What Are the 2025 Vehicle Tax Reforms in the UK?

The VED reforms are part of the UK Government’s broader plan to cut emissions and prepare for a zero-emission future. While noble in intent, these changes carry unintended financial consequences for older car owners.

Key Changes from April 1, 2025:

- Electric vehicles (EVs) will no longer be exempt from tax

- New petrol and diesel vehicles face steep first-year tax hikes

- All vehicle tax rates will rise in line with inflation (Retail Price Index)

- Luxury Car Supplement will apply to EVs priced over £40,000

These changes apply to both new and existing vehicles, but new car buyers will feel the impact most immediately.

How Will the New Car Tax Rules Affect Older Drivers?

The 2025 car tax reforms may not single out older drivers explicitly, but the consequences for this demographic are considerable.

These changes disproportionately affect older motorists due to several intersecting factors, from the age and emissions of the vehicles they drive to their economic position and lifestyle needs.

Ownership of Older, Higher-Emission Vehicles

Many senior drivers tend to own their vehicles outright, having purchased them years ago and maintained them in good condition.

While this reflects responsible ownership, it also means these cars are typically petrol or diesel models with higher emissions, placing them in higher VED bands under the new tax structure.

- Vehicles registered before 2017 were often bought without consideration for low-emission incentives.

- As a result, a large number of these vehicles now fall into mid-to-high emission categories, incurring annual tax increases of £200 to £500 or more.

- Older vehicles also tend to lack the technology needed to comply with Low Emission Zone (LEZ) requirements in cities, leading to daily access charges.

Limited Access to Cleaner Alternatives

Switching to a newer, low-emission vehicle or an EV may sound like a simple solution, but it’s not always realistic for older motorists:

- Financial constraints, particularly for those on pensions, make upgrading difficult.

- Tech apprehension plays a role too, some seniors are uncomfortable switching to EVs due to unfamiliar features like regenerative braking, digital dashboards, or app-based control systems.

- EV insurance and maintenance costs can also feel unpredictable or complex, adding to the hesitation.

Higher First-Year Costs on New Purchases

Even older drivers who are ready to buy a new car may be discouraged. If they opt for a petrol or diesel vehicle, common choices due to availability and affordability, they face:

- First-year VED as high as £5,490 depending on the emissions rating.

- Higher ongoing VED payments are increasing the total cost of ownership.

These realities leave older drivers caught in the middle, not eligible for exemptions, yet lacking the means or incentive to make the switch that would ease their tax burden.

How Much Will Drivers Pay in First-Year VED Under the New Rules?

The biggest increases are seen in the first-year VED (or showroom tax). This applies to new vehicle purchases based on their CO₂ emissions.

First-Year VED for New Cars (Effective April 1, 2025)

| CO₂ Emissions (g/km) | First-Year VED (2025) | Previous Rate | Increase |

| 0 (Electric Vehicles) | £10 | £0 | +£10 |

| 1–50 | £110 | £10 | +£100 |

| 76–90 | £270 | £135 | +£135 |

| 111–130 | £440 | £220 | +£220 |

| 151–170 | £1,360 | £680 | +£680 |

| 191–225 | £3,300 | £1,650 | +£1,650 |

| Over 255 | £5,490 | £2,745 | +£2,745 |

This sharp rise is meant to discourage the purchase of high-emission vehicles. However, many older drivers aren’t in a position to invest in a newer, lower-emission car.

What Will Electric Vehicle Owners Be Required to Pay From 2025?

EVs were previously exempt from VED, but this will no longer be the case from April 2025.

Key Costs for EV Owners:

- First-Year Tax: £10

- Standard Annual Tax from Year 2: £195

- Vehicles priced over £40,000: £425 Luxury Car Supplement

- Total yearly cost for high-end EVs: £620

This change marks the end of one of the most attractive incentives for EV adoption and could discourage older drivers from switching to electric cars, especially given the high upfront cost of new EVs.

What Are the Tax Implications for Petrol and Diesel Cars?

Older petrol and diesel vehicles are some of the hardest-hit by the VED reforms.

Example Tax Increases for Popular Petrol/Diesel Models

| Vehicle Model | Emissions (g/km) | VED 2024 | VED 2025 | Increase |

| Toyota Aygo X (Petrol) | 125 | £220 | £440 | £220 |

| Nissan Qashqai Mild Hybrid | 144 | £270 | £540 | £270 |

| Range Rover Sport (Diesel) | 194 | £1,650 | £3,300 | £1,650 |

| BMW M4 (Petrol) | 248 | £2,340 | £4,680 | £2,340 |

For drivers who own or plan to buy performance vehicles or SUVs, the cost increases are significant. Many of these models are owned by older drivers who value comfort and performance, but the financial strain may force reconsideration.

How Are Vehicles Registered Before 2017 Taxed?

Understanding how older vehicles are taxed is critical, especially as a large number of senior drivers own cars from before 2017, when the vehicle tax structure was quite different.

Two Taxing Methods: By CO₂ or Engine Size

The DVLA splits pre-2017 cars into two broad categories depending on the date of first registration.

1. Vehicles Registered Between 1 March 2001 and 31 March 2017

These cars are taxed based on their CO₂ emissions. The system uses 13 tax bands, ranging from A to M. The more your car pollutes, the higher the annual fee.

| Band | CO₂ Emissions (g/km) | Approx. Annual Tax |

| A | Up to 100 | £20–£30 |

| F | 166–175 | £265–£330 |

| M | Over 255 | £620–£760+ |

This system heavily penalises vehicles with larger engines or older technologies, many of which are still in use among retirees.

2. Vehicles Registered Before 1 March 2001

Older cars are taxed by engine size:

- Under 1549cc: £220 per year

- Over 1549cc: £360 per year

This fixed approach may seem straightforward, but it offers no benefit to drivers with clean, older engines and no escape for those with higher fuel consumption.

Impact on Seniors

Many older drivers continue using vehicles purchased over a decade ago, trusted models like the Ford Focus, Vauxhall Corsa, or even classic Rover or Toyota saloons.

For them, the new VED system offers no reward for responsible long-term ownership, and instead introduces higher yearly charges with little or no incentive to keep their existing cars.

How Are Plug-in Hybrids and Mild Hybrids Taxed in 2025?

The 2025 VED system ends the preferential treatment of hybrids.

- Plug-in hybrids emitting 1–50g/km CO₂ will pay £110 first-year tax

- 51–75g/km: £130

- 76–90g/km: £270

- Mild hybrids are taxed like traditional petrol vehicles

These changes may make hybrid cars less attractive, especially to cost-conscious older drivers.

How Does the DVLA Track Unpaid or Expired Car Tax?

With the discontinuation of the physical tax disc in 2014, many people, especially older drivers used to traditional reminders, have found it more difficult to stay on top of renewals. However, the DVLA’s enforcement system is now more robust than ever.

Automated Monitoring Using ANPR

The DVLA uses Automatic Number Plate Recognition (ANPR) technology cameras installed on motorways, urban streets, and mobile police units to scan license plates and cross-reference them with their vehicle tax database.

If a car is untaxed, the system automatically triggers enforcement action.

Consequences of Non-Payment

- Late Licensing Penalty (LLP): An £80 fine is sent by post. If paid within 28 days, it’s reduced to £40.

- Clamping and Impounding: Continued non-payment leads to vehicle clamping. Owners must pay a release fee of £100–£200, plus a daily storage fee of £21.

- Destruction of Vehicle: In cases of prolonged default, the vehicle may be impounded and destroyed.

- Court Prosecution: Driving without tax is a criminal offence. Fines can reach £1,000 or five times the unpaid tax, whichever is greater.

What Older Drivers Should Know?

Older motorists may miss online reminders or misplace digital communication. It’s advisable to:

- Sign up for DVLA email or text reminders at GOV.UK

- Keep the V11 reminder letter in a visible place until the tax is paid

- Use a calendar or smartphone alarm to mark renewal dates every 12 months

The current system assumes digital literacy, which not all seniors may have, putting them at higher risk of non-compliance despite good intentions.

What Can Older Drivers Do to Prepare for These Changes?

With the reforms in motion, proactive preparation is key.

Here’s what older drivers should consider:

- Use the GOV.UK tax checker to understand your car’s emissions and tax band

- Check your V5C document for CO₂ data

- Compare the cost of replacing your vehicle with a low-emission model

- Seek financial advice or guidance from driving organisations

- Factor VED into your budget for car ownership

Who Qualifies for Car Tax Exemptions in 2025?

Despite the changes, some groups remain exempt from paying VED:

Still Exempt from VED:

- Vehicles used by disabled individuals

- Classic cars (over 40 years old)

- Mobility scooters and invalid carriages

- Agricultural and forestry vehicles

- Steam-powered vehicles

Even exempt vehicles must still be declared with the DVLA (zero-rated tax).

How Are Older Drivers and Advocacy Groups Responding?

The new tax regime has sparked significant concern among older drivers, many of whom feel they are being unfairly penalised. Advocacy groups and road safety charities are pushing for greater fairness and accessibility in the UK’s vehicle tax reforms.

Drivers’ Voices

Drivers born between 1946 and 1962 are speaking out. Many feel that while they’re not the primary cause of current emissions issues, they’re being asked to pay the highest price. Here are some of the most common sentiments:

- “I’ve had my car for 15 years. It’s perfectly roadworthy. Why should I be forced to get rid of it?”

- “I don’t drive much, just to the shops and back. But my tax is going up like I’m a daily commuter.”

- “I can’t afford a new electric car. I’m on a state pension.”

What Advocacy Groups Are Saying?

Organisations like Age UK, IAM RoadSmart, and The RAC Foundation are voicing these concerns in Parliament and the media.

Their key recommendations include:

- Mileage-based tax systems that favour light vehicle users, especially older adults

- Grants and scrappage schemes for low-income, elderly drivers to help them upgrade to compliant vehicles

- Digital inclusion initiatives to ensure all drivers receive timely tax and renewal reminders

- Public transport alternatives for seniors, especially in rural areas, where car use is unavoidable

Dawn Cranmer from ALA Insurance summarised the issue well, stating:

“These changes will undoubtedly add to the financial burden for many older drivers. More support and clearer guidance are essential to help this group navigate such significant changes.”

As reforms unfold, continued pressure from advocacy groups may push the government to reconsider certain elements, but as it stands, the new car tax rules offer little relief for older motorists.

What’s the Future Outlook for Senior Drivers in the UK?

While the government aims to reduce emissions, it must also address the mobility and affordability needs of older drivers. With many seniors reliant on their cars for social, medical, and daily activities, there’s growing pressure on the government to:

- Introduce low-mileage tax reductions

- Offer transition grants or scrappage schemes

- Simplify access to low-cost electric vehicles

Until such measures are introduced, many older drivers could face ongoing financial strain unless they adapt quickly to the changing tax landscape.

FAQs About Older Drivers Car Tax Changes

Will older drivers be taxed more in 2025?

Yes. Those with older petrol or diesel cars will pay significantly more due to higher VED bands.

Are pensioners exempt from car tax in the UK?

No, not by age alone. Only certain conditions, such as disability or historic vehicle status, qualify for exemption.

What’s the cost of taxing an electric car from April 2025?

EVs will pay £10 in the first year and £195 per year after. High-value EVs (£40,000+) will pay £620 per year for five years.

Can I reduce my tax by driving less?

Not under the current system. However, a mileage-based tax may be introduced in the future, which could benefit low-mileage users like older drivers.

How do I know what tax band my car is in?

Check your V5C logbook or use the GOV.UK vehicle tax checker.

What if I don’t pay my car tax on time?

You risk fines, clamping, impounding, and even legal action. ANPR systems detect unpaid vehicles automatically.

Are hybrid vehicles still tax-friendly?

Not as much. Plug-in hybrids face new taxes, and mild hybrids are treated like standard petrol vehicles.