What Is Benefit-in-Kind (BIK) Tax?

Benefit-in-Kind (BIK) tax applies to employees who receive perks that aren’t part of their direct salary, such as a company car, accommodation, or private health insurance. These non-cash benefits are taxed as if they were part of the employee’s income. Employers report the value of these benefits to HMRC, which then calculates the tax due.

When it comes to company cars, several variables determine the BIK liability:

- The P11D value of the car (the list price including VAT and extras)

- The fuel type (e.g., electric, diesel, petrol, hybrid)

- The CO₂ emissions of the vehicle

- The car’s registration date

- The employee’s income tax band

The BIK percentage is applied to the P11D value to calculate the taxable benefit amount. The higher the emissions or value of the vehicle, the more tax the employee pays. This system is designed to both tax luxury and high-emission cars more and encourage adoption of low-emission vehicles.

Why Does BIK Tax Matter to UK Businesses in 2025?

The relevance of BIK tax has never been more pronounced than in 2025, following new policies implemented by Chancellor Rachel Reeves. These changes, officially effective from 6 April 2025, reshape how businesses use company vehicles within their employee benefits packages.

Over 760,000 company car drivers in the UK are directly impacted. For businesses, especially SMEs and startups, these reforms represent both a financial and operational inflection point.

BIK tax is not just a regulatory requirement, it’s a cost management tool, a staff retention mechanism, and increasingly, a measure of environmental responsibility. Poor planning around these changes could result in:

- Higher employer NICs

- Decreased employee satisfaction due to reduced take-home pay

- Reputational risks tied to environmental goals

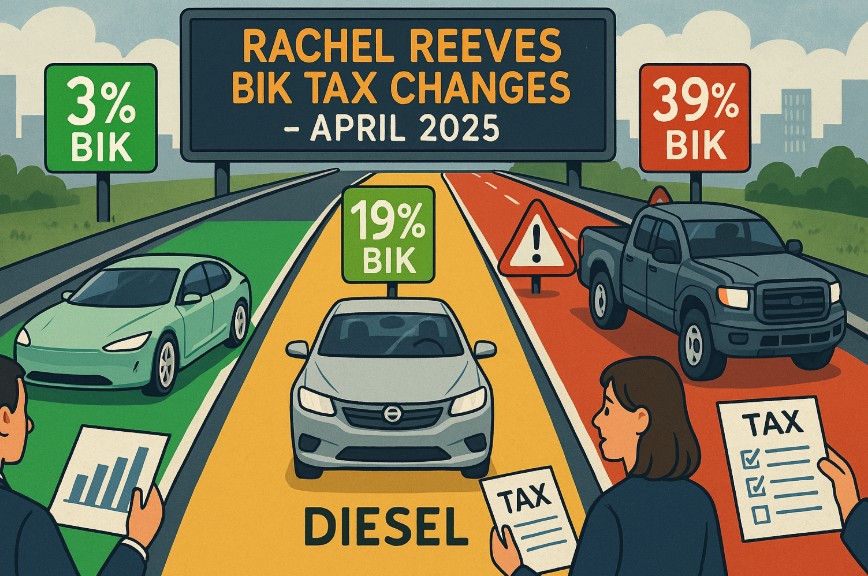

What Are Rachel Reeves’ Proposed Changes to BIK Tax?

In her role as Chancellor, Rachel Reeves has taken steps to overhaul BIK taxation to align with environmental priorities and create fiscal balance. First announced in the Autumn Budget of 2024 and implemented in April 2025, the new BIK structure introduces a graduated tax system that increasingly penalises high-emission vehicles while supporting a gradual shift to electric.

Highlights of the BIK Reform Plan

- A steady increase in BIK rates for electric vehicles over a five-year period

- Sharper tax hikes for plug-in hybrid models

- A reclassification of double cab pickups under standard car tax rules if they don’t meet commercial-use criteria

- Continued surcharges on diesel vehicles that fail to meet RDE2 emissions standards

These measures are part of a broader plan to promote sustainability in fleet management while securing long-term tax revenues.

What Are the Key BIK Tax Changes from April 2025?

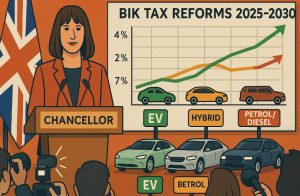

BIK Rates for Electric Vehicles (2025–2030)

| Tax Year | BIK Rate (EVs) |

| 2024/25 | 2% |

| 2025/26 | 3% |

| 2026/27 | 4% |

| 2027/28 | 5% |

| 2028/29 | 7% |

| 2029/30 | 9% |

Electric vehicles, although facing rising rates, still retain a considerable advantage in BIK terms over their petrol and diesel counterparts. This structure provides clarity for businesses planning vehicle procurement over the medium to long term.

BIK Rates for Plug-in Hybrid Vehicles (1–50g/km CO₂)

| Electric Range (Miles) | Previous BIK Rate | 2028/29 Rate | 2029/30 Rate |

| >130 | 5% | 18% | 19% |

| 70–129 | 8% | 18% | 19% |

| 40–69 | 12% | 18% | 19% |

| 30–39 | 14% | 18% | 19% |

| <30 | 17% | 18% | 19% |

The sharp increase, regardless of electric range, signals a policy shift away from supporting hybrid technology as a sustainable long-term option.

BIK Rates for High-Emission Vehicles

| Emission Level (CO₂ g/km) | Current Rate | 2028/29 | 2029/30 |

| 51–54 | ~25% | 19% | 20% |

| 55–159 | 26–36% | +1% | +1% |

| 160+ | 37% | 38% | 39% |

Vehicles that fall into the highest emissions category will experience a consistent one percentage point increase per year. Diesel vehicles that don’t meet emissions standards will still incur a 4% surcharge, capped at 37% until the higher thresholds apply.

How Will These BIK Changes Affect Company Vehicle Costs?

These tax changes alter the financial equation for both employers and employees:

- Employers face higher National Insurance contributions for high-emission vehicles.

- Employees using company vehicles may see a notable reduction in take-home pay.

- Double cab pickups, previously classed as vans with flat-rate BIK, now face significantly higher car-based taxation.

In practice, offering a petrol or diesel vehicle as a company benefit could soon cost thousands more annually than offering an electric alternative.

Case Example: BIK Cost Comparison (20% Tax Bracket)

| Vehicle Type | P11D Value | CO₂ Emissions | 2025/26 BIK Rate | Annual Taxable Benefit | Employee Tax (20%) |

| Petrol Hatchback | £28,000 | 125g/km | 30% | £8,400 | £1,680 |

| Hybrid SUV | £35,000 | 50g/km | 18% | £6,300 | £1,260 |

| Electric Saloon | £40,000 | 0g/km | 3% | £1,200 | £240 |

The comparative savings for EVs, especially when paired with salary sacrifice schemes, can be substantial.

What Does the Reclassification of Double Cab Pickups Mean?

Until April 2025, double cab pickups benefited from the same tax treatment as vans fixed-rate BIK, unaffected by emissions or vehicle value. Under new HMRC guidance, these vehicles must now pass a two-part suitability test to retain that classification.

Vehicles failing this test are taxed as cars under BIK rules, meaning:

- Tax is based on emissions and P11D value

- The effective BIK rate can rise to 39% by 2029/30

- Annual tax liabilities for high-spec pickups may exceed £10,000–£15,000

Transitional Relief

Any pickup ordered or leased before 6 April 2025 will continue to be treated as a van for BIK purposes until it is sold, the lease ends, or 5 April 2029 whichever comes first.

How Should Businesses Prepare for These Changes?

A structured response to the BIK reforms can help businesses maintain compliance and cost control.

Key Action Steps:

- Fleet Audit: Identify high-emission or reclassified vehicles in the fleet.

- Procurement Adjustments: Replace petrol and diesel models with electric or ultra-low-emission vehicles.

- Salary Sacrifice Optimisation: Align salary sacrifice schemes to prioritise EVs with favourable tax treatment.

- Policy Communication: Ensure HR and payroll teams understand and communicate the new BIK structure to staff.

- Financial Planning: Budget for increasing BIK-related employer liabilities in future tax years.

What Are the Broader Industry Implications?

These BIK reforms represent more than just tax adjustments, they hint at wider behavioural and economic shifts.

Changing Employer Strategies

As tax efficiency becomes more closely tied to sustainability, businesses are likely to explore alternative mobility benefits, including:

- EV lease schemes

- Mobility-as-a-benefit offerings

- Public transport allowances

- Cash alternatives to company cars

Impact on Trades and Rural Sectors

The reclassification of double cab pickups could affect thousands of businesses in construction, agriculture, and field services, with some tax burdens increasing by over £15,000 per vehicle annually.

A Clear Policy Signal

Rachel Reeves’ tax reforms make it clear: hybrids are no longer the end goal. Businesses that wish to remain tax-efficient must look to full electrification of their fleets.

What Should Businesses Do Right Now?

To remain competitive and compliant:

- Review fleet policies immediately

- Replace pending vehicle orders with electric or compliant alternatives

- Use transitional rules to your advantage if applicable

- Educate employees on new BIK tax impacts and options

- Seek professional tax advice to mitigate liabilities

Conclusion

The Rachel Reeves BIK tax reforms represent a significant recalibration of how business vehicles are taxed in the UK. From restructured rates for EVs to steep increases for hybrids and traditional vehicles, the policy reshapes corporate fleet planning and benefit structures alike.

Whether you’re a startup scaling operations or a large enterprise managing hundreds of vehicles, understanding and adapting to these reforms is essential. Forward-thinking businesses will not only stay compliant but also gain reputational and cost-saving advantages by transitioning to cleaner fleets.

Now is the time to evaluate your vehicle strategy, leverage available tax incentives, and embrace the shift towards a greener and more sustainable future.

Frequently Asked Questions About Rachel Reeves BIK Tax Changes

What is the BIK rate for electric vehicles in 2025/26?

The BIK rate for EVs rises from 2% to 3% starting 6 April 2025 and will gradually increase to 9% by 2029/30.

Are plug-in hybrids still tax-efficient under the new rules?

No. From 2028/29, hybrids will face BIK rates of 18%, increasing to 19% in 2029/30 eliminating much of their previous tax advantage.

How do the new rules affect double cab pickups?

If they don’t meet HMRC’s goods transport test, they are now taxed like cars, facing higher BIK rates based on emissions and value.

Will petrol and diesel cars become unaffordable as company vehicles?

They will remain legal, but tax liabilities will increase annually, making them less attractive from a cost perspective.

What transitional support is available for existing fleet vehicles?

Pickups ordered before 6 April 2025 will retain their van status until 5 April 2029 or until their lease ends or they’re sold.

Are salary sacrifice schemes still viable?

Yes, especially for EVs, which maintain low BIK rates and significant employee tax savings under such schemes.

Can small businesses absorb these costs?

It depends on fleet composition. Smaller firms should evaluate alternative transport benefits or transition quickly to EVs.