Words like “buy now”, “deposit,” or “add to cart” have become fixtures in the daily lives of many of us in today’s world. Whatever your needs, wants, or hobbies, the modern society we live in has become increasingly digitised. However, to keep all of these conveniences running smoothly, businesses around the world, whether small, family-run enterprises or multinational conglomerates, have all had to adapt to growing demand for online payments.

Consumers today demand fast, reliable, and safe checkouts, no matter the purchase or online activity engaged in. While it can all be a little overwhelming at times, keeping up with new payment trends, this mad rush for market dominance has also resulted in a huge wave of choices for modern, tech-savvy consumers.

To ensure you’re not left behind, these are modern payment options that shouldn’t be ignored if convenience and safety are what you’re after.

What Are the Most Effective Payment Methods for Startup Success?

Online Habits and Checkout Choices

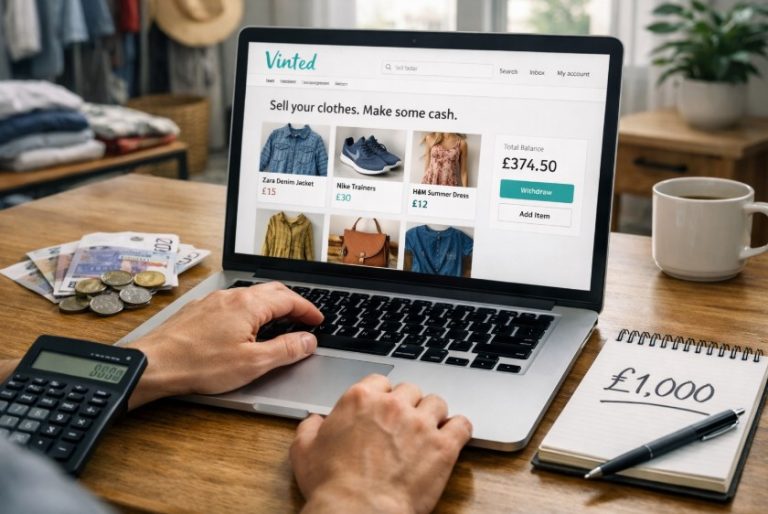

Modern life in a digital world has become defined by fast-paced services that are available on demand. With the growing demand for online shopping, more and more e-commerce options are popping up every day. These sites offer everything from clothing to groceries and luxury items, available at the click of a button.

From streaming films to ordering groceries, UK consumers interact with online services daily. Even hobbies and entertainment have migrated online, changing entire industries in the process. Online casinos are a key example of this shift as multitudes of players around the world now prefer digital gaming options to physical venues. These platforms have seen massive growth in the UK over the past few years, driven by mobile access and digital convenience.

Gaming reviewer Wilna van Wyk points out that local players often choose sites accepting Visa and Mastercard due to their familiarity and ease. These payment options are trusted, fast, and available to nearly everyone with a bank account.

Many casino platforms now highlight these options, knowing that quick deposits and secure payments attract more users. Bonuses, real-time deposits, and strong security help keep these sites at the top of users’ lists.

The habits formed in online entertainment, shopping, and gaming have influenced expectations everywhere. Startups need to mirror this simplicity. If your checkout doesn’t match the speed and clarity people have come to expect, they’ll take their business elsewhere. The purchase process must feel smooth from start to finish.

The Power of Choice

One payment method rarely suits everyone. That’s why giving users a range of options at checkout is one of the smartest moves a startup can make. Shoppers have personal preferences, some prefer cards, others want digital wallets. A few still like to pay via bank transfer or newer methods like crypto.

Take digital wallets. These are now used by millions across the UK. Apple Pay, Google Pay, and PayPal continue to grow as they’re often linked directly to phones, allowing for quick thumbprint payments. People trust these services for security and speed. For many, pulling out a card feels outdated when a fingerprint scan will do.

Card payments remain a strong choice too. Debit and credit cards are familiar, and people like knowing they have protections if something goes wrong. However, startups must make sure card payments are supported by systems that don’t delay the process. Long loading times or extra form fields can scare customers off.

Bank transfers, especially with open banking tools like TrueLayer or GoCardless, are also becoming more common. With online-based strategies like SEO marketing and social media advertising making online services vastly more popular, services like these offer direct account-to-account transfers with fewer fees.

They suit both businesses and buyers who prefer not to use cards. Some users even favour cryptocurrency, especially in tech-savvy circles, though this is still niche in the UK.

Here’s why a wider payment mix helps:

- More options reduce friction at checkout

- Different people trust different methods

- International customers often prefer local options

- More options equal greater convenience

The easier it is for someone to complete their order, the more likely they are to do it. Payment isn’t just about taking money; it’s part of the user journey. Friction here can ruin a sale that took hours or weeks to win.

Mobile First, Always

The smartphone is now the first stop for many purchases. From checking product reviews to ordering takeaway, phones do it all. For startups, this means your checkout has to work flawlessly on mobile. Payment methods should fit the small screen and require minimal effort.

Fumbling through clunky forms or struggling to input card numbers can push people to close the tab. Compare that to the ease of Apple Pay. A double tap, a face scan, and it’s done. That’s the level of simplicity users expect.

Digital wallets shine here again. They are built for mobile use and often allow one-touch payments while supporting omnichannel functionality. If your startup is targeting younger users or impulse purchases, missing out on mobile-friendly methods is a major error.

Apps and mobile-optimised sites should load quickly and present payment options clearly. Hidden buttons, confusing steps, or missing autofill features can break trust. This matters even more for startups. People may not know your brand yet, so everything about the experience must feel secure and polished.

Subscription Models and Recurring Payments

Many new businesses run on subscriptions these days. Whether it’s software, fitness classes, or monthly treats, recurring payments power the cash flow, and this monetisation model makes it both more convenient and more affordable to the masses. However, these also rely on payment systems that support regular billing without a hitch.

Card-based recurring payments are common, but they come with a risk. Cards expire or get replaced. When that happens, payments fail, and customers often don’t come back. Direct debits or bank-linked services can offer more stability while supporting financial inclusion. These avoid the expiry issue and often work out cheaper in transaction fees, too.

Services like Stripe and GoCardless allow startups to automate billing and send reminders. That reduces manual work and lowers failed payment rates. Some also include built-in retry systems if a payment fails the first time.

Conclusion

A payment process should never be an afterthought. For UK startups, it’s one of the most important pieces of the puzzle. People want speed, choice, and trust. They want to pay the way they prefer and move on with their day.

By offering popular methods, focusing on mobile use, and keeping things smooth, new businesses stand a far better chance of turning clicks into customers. When someone reaches the checkout, make sure they’ve got every reason to finish the journey.