Finding the right UK trading platform can be the first big challenge for any beginner investor, as the market is packed with those. Many offer low trading fees or a smooth mobile app, but only a handful make new users feel comfortable and safe.

In 2026, the best trading platform in the UK for a newcomer does much more than offer a low minimum deposit or a flashy design.

What truly counts is knowing your money is protected, all fees are clear, and you have direct access to share trading, mutual funds, and fractional shares. Reliable educational resources are just as important.

This guide singles out the top trading platforms for beginners. It puts a spotlight on safety, simplicity, and strong investment options that help new users start trading with confidence.

We have tested a range of trading platforms, paying close attention to real trading fees, the ease of each mobile app, and how well each brokerage account works for people just starting out. If you want to get going in the stock market, the right platform puts support and trust first, so you are not left to figure things out on your own.

How We Chose the Best Trading Platforms for Beginners?

We reviewed over 30 UK trading platforms to find the best options for beginner investors. Our approach focused on trading platforms with clear trading fees, flexible minimum deposit choices, and a simple mobile app experience.

We judged the strength of educational resources, investment options like mutual funds and share trading, and whether each brokerage account met FCA safety standards.

Each investment platform was tested through real user feedback and independent market analysis. Our top picks help beginner investors start trading, manage trading costs, and access important features without feeling overwhelmed.

7 Best Trading Platforms for Beginners in 2026

| Rank | Platform | Minimum Deposit | Standout Feature | Best For | Notable Rating* | Mobile App |

| 1 | XTB | £0 | 0% commission stocks/ETFs, advanced educational resources | Beginners, education-first investors | 4.7/5 | Yes |

| 2 | Freetrade | £0 | Fractional shares, easy share trading | UK stock investors | 4.6/5 | Yes |

| 3 | Trading 212 | £1 | Commission free trading, wide investment options | Low-cost starters | 4.5/5 | Yes |

| 4 | eToro | $50 (~£40) | Copy trading, social investment network | Social traders | 4.2/5 | Yes |

| 5 | CMC Invest | £0 | Extensive asset range, strong trading tools | Versatile investors | 4.1/5 | Yes |

| 6 | IG | £250 | Advanced charting, paper trading | Aspiring advanced traders | 4.0/5 | Yes |

| 7 | Interactive Investor | £25/mo | Flat fee model, curated funds | Active investing, funds | 3.9/5 | Yes |

1. XTB – Best for Beginners

XTB consistently ranks among the top trading platforms for beginners in 2026. New investors benefit from a platform designed not just to simplify trading, but to make learning intuitive from day one. With XTB, you get:

- 10,900 instruments to invest and trade worldwide

- £0 minimum deposit, so opening your first investing account is simple

- 0% commission on stocks and ETFs up to €100,000 per month

- A clean, intuitive mobile app and xStation platform that make trade execution quick and straightforward

- Outstanding educational resources that help beginners develop real, actionable trading skills

A wide range of investment options, including mutual funds and fractional shares - Market analysis tools and negative balance protection for added confidence

- You can earn up to 4.25% on your GBP free funds

- Flexible Stocks and Shares ISA making your money work hard tax free.

XTB serves more than 2 million clients worldwide, is FCA-regulated in the UK, and brings over 20 years of industry experience to new investors.

With its blend of low costs, strong support, trusted regulation, and clever features, XTB stands out as one of the best platforms for anyone beginning their investment journey in the UK.

Capital at risk. Investment values can rise or fall. 0% commission up to €100k/month. Other fees may apply. XTB Ltd. is an investing platform. Tax treatment depends on your individual circumstances and ISA regulations which may change.

2. Freetrade

Freetrade is a UK trading platform designed for beginner investors who value simplicity and transparency. With Freetrade, users can:

- Open a brokerage account with a £0 minimum deposit

- Access a streamlined mobile app for easy share trading and portfolio management

- Invest in fractional shares, mutual funds, and a range of investment options

- Benefit from transparent trading fees and a clear, commission-free structure

The company’s educational resources support self-guided learning, making it straightforward for new investors to start trading without unnecessary complexity.

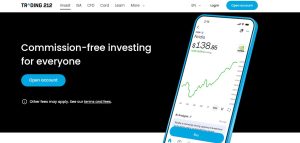

3. Trading 212

They offer a low entry point for beginner investors. The company’s platform includes:

- £1 minimum deposit to open a brokerage account

- Mobile app with basic share trading, fractional shares, and portfolio tracking

- Support for commission free trading on stocks, ETFs, and mutual funds

- A selection of investment options, including ISA interest rates and general investment accounts

- Clear structure for trading fees and straightforward transactions

While Trading 212 appeals to those seeking a simple setup and low costs, educational resources and market research features may feel limited compared to some other trading platforms.

4. eToro

The company is a global trading platform that appeals to beginner investors interested in social and copy trading features. The company provides:

- A starting minimum deposit of $50 (approx. £40) for UK accounts

- Mobile app and web platform enabling access to stocks, ETFs, and mutual funds

- Copy trading functionality, allowing users to mirror the trades of experienced investors

- Range of investment options including foreign exchange and fractional shares

- Simple process to open a brokerage account and transparent approach to trading fees

eToro’s combination of community-driven tools and diverse markets offers a unique take on share trading for those new to investment platforms.

5. CMC Invest

CMC Invest gives beginner investors straightforward access to multiple investment options and asset classes. The company provides:

- £0 minimum deposit for opening a brokerage account

- Convenient mobile app and online access for share trading and portfolio management

- Broad selection of assets including mutual funds, ETFs, and foreign exchange

- Built-in trading tools to assist with basic trading strategy and decision-making

- Clearly displayed trading fees and competitive transaction fees

Their transparent approach to costs and range of account types help new users start trading and diversify their portfolios without unnecessary complexity.

6. IG

The company enables beginner investors to gain exposure to a broad array of markets and asset types through its investment platform. The company features:

- £250 minimum deposit to open a brokerage account

- Robust mobile app and desktop platform supporting share trading, mutual funds, and foreign exchange

- Tools for paper trading and demo account access to practice strategies

- Extensive market analysis and trading tools for building investment confidence

- Transparent trading fees and detailed information on transaction fees

IG’s educational resources and research materials aim to help new users start trading with greater understanding, though the higher account minimum may not suit every beginner.

7. Interactive Investor

This broker appeals to beginner investors looking for a flat-fee approach and extensive investment options. The company offers:

- £25 monthly account fee with no minimum deposit for a standard brokerage account

- Access to a diverse selection of shares, mutual funds, ETFs, and investment trusts

- Support for fractional shares and straightforward share trading via both web and mobile app

- Tools for portfolio monitoring, account management, and clear disclosure of trading fees

- Educational resources and guides to help users start trading and understand tax impacts, like capital gains tax

Interactive Investor’s predictable cost structure and comprehensive range of investment choices can appeal to those planning to actively manage and diversify their holdings.

Summing Up

Choosing between UK trading platforms is often the first real decision for beginner investors. Every investment platform featured here stands out in its own way, whether you care most about low trading fees, smooth share trading, forex trading, or a user-friendly mobile app.

Comparing these trading platforms puts new investors in a stronger position to manage money wisely and avoid mistakes that could set you back.

FAQs

Which trading is best for beginners?

Share trading and investing in mutual funds or exchange traded funds are straightforward ways for beginner investors to access the stock market through regulated trading platforms.

What is the best platform to start trading?

A platform with low trading fees, a user-friendly mobile app, and clear educational resources works well. Many beginner investors choose XTB for its balance of features and support.

What is the 7% rule in stocks?

The 7% rule means selling a stock if it drops 7% below your purchase price, helping manage risk and limit losses.

What is the best UK trading platform?

The best UK trading platform for beginners is XTB, being one with transparent fees, strong regulation, and a simple app.