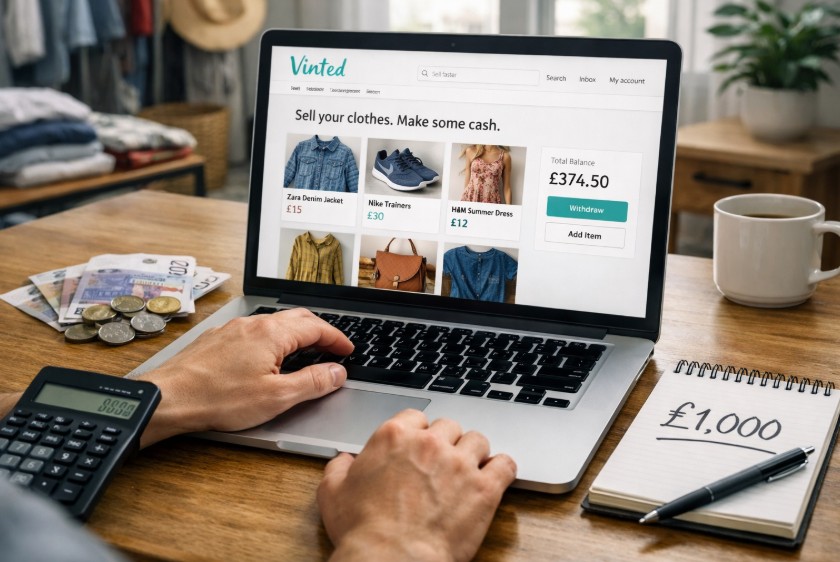

In the UK, individuals can earn up to £1,000 in gross income from Vinted sales each tax year (6 April to 5 April) without paying tax, thanks to the Trading Allowance.

If your total income from casual selling exceeds this threshold, you must register for Self Assessment with HMRC. The distinction between selling personal items and trading for profit plays a crucial role in your tax obligations.

Key Takeaways:

- You can earn £1,000 tax-free annually from Vinted and other platforms.

- Earnings above this amount must be declared to HMRC.

- Selling personal items at a loss is generally not taxable.

- Vinted must report sellers who exceed 30 items or £1,700 in sales.

- Register for Self Assessment if you cross the threshold or operate as a business.

How Much Can You Earn on Vinted Before Paying Tax in the UK?

In the UK, Vinted sellers benefit from the £1,000 trading allowance, which allows individuals to earn up to £1,000 in total income from casual or hobby-based selling without paying tax or notifying HMRC. This limit applies to gross income, that is, the total amount received before any deductions or expenses.

This allowance is part of the government’s efforts to support small-scale, non-professional sellers who may use platforms like Vinted occasionally to declutter or sell unwanted items.

If you stay under this £1,000 threshold during a tax year (from 6 April to 5 April), there’s no need to file a Self Assessment tax return for these earnings.

However, once your gross earnings exceed £1,000, even if no profit is made, you are legally required to register for Self Assessment and possibly pay tax on profits. Keeping track of total income is essential to stay within the legal limits and avoid penalties.

Do You Need to Pay Tax When Selling on Vinted?

Whether you need to pay tax when selling on Vinted depends on the type of items sold, your intent, and your total income. If you’re selling unwanted personal belongings that were originally purchased for more than you resell them, and your total sales remain below the £1,000 threshold, you’re unlikely to be liable for tax.

However, if you’re regularly buying items to resell for profit, making handmade goods, or operating in a way similar to a business, HMRC may consider you a trader. In this case, even if your sales seem small, you must declare this income, especially if you exceed the trading allowance.

It’s also worth noting that profits, not just income, are typically what HMRC taxes. But to access allowable deductions, you must be registered. Failing to report qualifying income may result in penalties, so it’s vital to understand your position clearly.

What Happens If You Exceed the £1,000 Trading Allowance?

Crossing the £1,000 threshold doesn’t automatically mean you owe tax, but it does trigger tax obligations that must be met.

Here’s what happens next:

- You must register for Self Assessment with HMRC by 5 October following the end of the tax year in which you earned over £1,000.

- You will need to submit a tax return, declaring your earnings and calculating your taxable profits after deducting any allowable business expenses.

- If your total income (including PAYE or other earnings) exceeds £12,570, you may need to pay Income Tax on your Vinted profits.

- Even if you are under the personal allowance, late registration can result in fines or interest charges.

To stay compliant:

- Keep records of income and expenses.

- Use HMRC tools or speak with a tax advisor to confirm your obligations.

- Register online for Self Assessment promptly to avoid delays.

Taking action quickly ensures you avoid penalties and maintain peace of mind.

What Are the HMRC Reporting Rules for Vinted Sellers in 2024?

From January 2024, digital platforms like Vinted are required to share seller information with HMRC. This is not a new tax but part of a global transparency agreement under OECD rules.

HMRC will receive your information from Vinted only if you:

- Sell 30 or more items in a calendar year, or

- Earn over €2,000 (approx. £1,700) in gross sales annually.

This data-sharing does not mean you automatically owe tax. However, it puts your activity on HMRC’s radar. If you fall under either criterion, Vinted will notify you before passing your details to HMRC.

Importantly, this reporting doesn’t change the tax rules, it just makes enforcement easier. Sellers should maintain accurate records and be honest about their income to avoid future disputes or audits.

How Does HMRC Define Personal vs Business Selling?

When it comes to taxation on Vinted, HMRC draws a distinct line between clearing out personal items and trading for profit. Knowing where you fall is essential to determine if you owe tax.

Clear-out Selling Examples (Non-taxable)

If you’re selling:

- Clothes that no longer fit or suit your style

- Children’s outgrown clothes and toys

- Unwanted gifts or duplicates from your home

And if these items are sold at a loss, or under their original purchase price, then HMRC considers this a non-taxable event. This applies even if you sell via digital platforms occasionally.

Trading Examples (Taxable)

Tax becomes applicable if you are:

- Buying items at car boot sales or online with the intention to resell for profit

- Upcycling and selling furniture or clothes regularly

- Making handmade products or sourcing items wholesale

- Repeatedly listing similar types of items to make money

These behaviours demonstrate a business motive, and HMRC may treat your activity as self-employment.

What Qualifies as a Side Hustle Under HMRC?

A side hustle typically involves:

- Any activity that generates income outside of full-time employment

- Using platforms like Vinted to resell items at a markup

- Having consistent or structured selling patterns

Once your gross income exceeds £1,000 from any side hustle, you must report this income. HMRC doesn’t need to see profit to expect registration, the trigger is the revenue threshold.

Understanding this distinction will help you stay compliant and avoid unexpected tax bills or investigations from HMRC.

Do You Need to Register as Self-Employed to Sell on Vinted?

Not everyone selling on Vinted needs to register as self-employed. The requirement depends on whether your activity aligns with casual selling or business-like trading.

Difference Between Casual Sellers and Regular Traders

Casual sellers typically:

- Sell unwanted personal items

- Do not operate with the intention to make a profit

- Sell items occasionally without patterns or repetition

Regular traders:

- Buy or make items specifically to resell

- Have a structured approach to pricing, inventory, and listings

- Are likely to exceed the £1,000 trading allowance

When Registration is Required?

You must register for Self Assessment if:

- Your gross income from trading exceeds £1,000 in a tax year

- You’re engaging in trading activities, regardless of profit

- You sell a personal item for more than £6,000, potentially triggering Capital Gains Tax

Failure to register by 5 October following the end of the tax year could result in fines and interest.

Step-by-step: How to Register for Self Assessment?

- Visit the official GOV.UK registration page

- Create a Government Gateway account

- Provide your personal and business details

- Receive your Unique Taxpayer Reference (UTR) by post

- Submit your return online by 31 January of the following year

If it’s your first time, allow a few weeks for the registration and activation code. Once registered, you can monitor your tax obligations through your online account.

By staying informed and registered, you ensure that your earnings from Vinted remain above board and legally compliant.

What Are the Tax Implications of Selling Personal Items on Vinted?

Selling your own belongings through Vinted, such as second-hand clothes, generally doesn’t result in a tax liability, especially if you’re selling them at a loss. HMRC does not require you to pay tax on items that sell for less than their original purchase price.

However, if you sell a single item or collection for more than £6,000, you may be liable for Capital Gains Tax (CGT). Even then, CGT only applies if your profit exceeds the £3,000 annual allowance.

In most cases, occasional sellers do not need to worry. The tax implications primarily arise when your activity becomes regular or profit-oriented.

To avoid complications, keep a record of purchase prices and sales amounts. This way, if you are ever questioned, you can clearly demonstrate that the transactions were non-taxable.

How to Keep Records of Your Vinted Sales for Tax Purposes?

Even if you’re below the tax threshold, record-keeping is essential. It protects you in case HMRC requests evidence of your sales and ensures that you stay compliant if your income increases in the future.

Here’s what to track:

- Dates of each sale

- Item descriptions and sale prices

- Original purchase costs (if applicable)

- Platform fees or postage costs

- Total revenue and profits

Storing this information digitally is best, whether through a spreadsheet, accounting app, or even downloaded sales history from Vinted. By keeping thorough records, you’ll be ready to provide accurate information to HMRC if needed and avoid errors in your tax return.

Vinted vs Other Online Selling Platforms: Do the Same Tax Rules Apply?

The tax rules that apply to Vinted also apply to platforms like eBay, Etsy, Depop, and others. Each is governed by the same £1,000 trading allowance set by HMRC.

What varies slightly is how platforms report data to HMRC. Vinted must now report sellers who exceed 30 items or £1,700 in sales, similar to eBay and Etsy under the OECD agreement.

Regardless of platform, if you cross the threshold, or are trading for profit, the same rules apply:

- Register for Self Assessment

- Report income to HMRC

- Keep sales and expense records

Whether you’re on Vinted or any other marketplace, the tax treatment is determined by your sales behaviour, not the platform itself.

What Are the Penalties for Not Reporting Your Vinted Income to HMRC?

Failing to report your taxable income from Vinted can lead to financial penalties and legal consequences. HMRC expects full disclosure, especially now that platforms report your sales data.

Key risks include:

- £100 late filing penalty if your return is up to 3 months late

- Additional penalties for longer delays

- Interest on unpaid tax

- Potential investigation or audit

To avoid penalties:

- Track your income year-round

- Register for Self Assessment if you exceed thresholds

- Submit your return by 31 January following the tax year

Remember, registering doesn’t always mean you owe tax, but failing to register when required will certainly cause trouble.

Conclusion

Selling on Vinted can be a convenient way to earn extra income, but it’s vital to understand your tax responsibilities. The £1,000 trading allowance offers some flexibility for casual sellers, but those operating with a profit motive or selling at scale must comply with HMRC regulations.

Keep clear records, know the difference between personal selling and trading, and register for Self Assessment if your income demands it. With new digital reporting rules in place, it’s more important than ever to ensure your sales activity remains transparent and within the law.

If in doubt, consult GOV.UK or seek professional tax advice.

FAQs

Do I have to pay tax on Vinted if I only sell my old clothes?

No, selling your personal items at a loss usually isn’t taxable, especially if you don’t exceed the £1,000 trading allowance.

What is the difference between trading income and casual income?

Trading income involves buying or making goods to sell for profit, while casual income comes from selling personal belongings occasionally.

When must I register for Self Assessment?

You must register if your total side income exceeds £1,000 in a tax year or if you’re considered to be trading.

Will Vinted notify HMRC about my sales?

Yes, if you sell 30 or more items or exceed £1,700 in revenue, Vinted must report your data to HMRC.

Can I earn £1,000 tax-free for each platform I sell on?

No, the £1,000 trading allowance is per person, not per platform. All side income is counted together.

How does HMRC define “trading” on platforms like Vinted?

HMRC considers it trading if you regularly buy or make items to resell for profit, even if part-time.

What if I already pay tax through PAYE—do I still need to report Vinted sales?

Yes, if your side income exceeds £1,000 or you are trading, you must still report and pay tax through Self Assessment.