A statement of profit and loss, also known as an income statement, is a primary financial statement used by small business owners to assess their financial status. It analyzes a company’s expenses and revenue to determine its net income. This statement is crucial for startup companies as it helps monitor growth, profitability, and identify damaging business practices.

To prepare a statement of profit and loss, it is important to maintain meticulous bookkeeping, record all transactions, and keep track of cost of goods sold. Utilizing templates provided by reputable sources like Microsoft, Google, or QuickBooks can simplify the process.

Let’s explore the purpose and importance of a profit and loss statement in the next section.

The Purpose and Importance of a Profit and Loss Statement

A profit and loss statement is a crucial financial document that plays a vital role in assessing a company’s financial health and performance. Also known as an income statement, it provides a comprehensive overview of a company’s profitability and growth by evaluating its revenues, expenses, and net income.

The purpose of a profit and loss statement is to determine whether a company is profitable and, if so, by how much. By monitoring sales trends and comparing expenses, businesses can identify areas of strength and opportunities for improvement. This statement enables companies to make informed decisions regarding product development, marketing strategies, and cost management.

Moreover, a profit and loss statement serves as a powerful tool for tax planning and compliance. By accurately calculating their net income, businesses can determine their tax liability, ensuring legal and accurate reporting.

One valuable technique for analyzing a profit and loss statement is utilizing a common size statement of profit and loss. This method involves expressing each line item as a percentage of net sales, providing a standardized comparison across different periods. This analysis helps identify trends, anomalies, and areas of concern, giving a deeper understanding of a company’s financial performance.

Top Benefits of a Profit and Loss Statement:

- Assessing profitability and growth

- Identifying areas for improvement

- Tax planning and compliance

- Comparison and analysis with common-size statements

| Benefits | Explanation |

|---|---|

| Assessing profitability and growth | This document helps businesses determine their profitability and evaluate their growth over a specific period. It provides insights into the company’s ability to generate a profit and indicates its financial health. |

| Identifying areas for improvement | By analyzing the profit and loss statement, companies can identify specific areas where costs are high, revenues are low, or where performance is lagging. This information allows them to take proactive measures to improve their financial position. |

| Tax planning and compliance | Profit and loss statements are essential for tax planning and compliance. They provide accurate information about a company’s financial position, allowing businesses to calculate their tax liability and ensure compliance with tax regulations. |

| Comparison and analysis with common-size statements | Using common-size statements, businesses can compare their financial performance across different periods and make meaningful comparisons. This analysis highlights trends, abnormalities, and potential areas of concern, facilitating better decision-making. |

“A profit and loss statement is not just a financial document; it is a powerful tool that provides valuable insights into a company’s financial health, growth potential, and areas for improvement.”

Steps to Prepare a Statement of Profit and Loss

To prepare a profit and loss statement for your small business, follow these essential steps:

- Gather Financial Information: Start by collecting all relevant financial data, including transaction listings, sources of income, and expenses. Ensure that you have accurate and detailed records.

- Determine the Reporting Period: Decide on the timeframe for your profit and loss statement. It can be monthly, quarterly, or annually, depending on your business’s needs.

- List Revenue: Include all sources of revenue in your statement. This may include sales, service fees, or any other income generated by your business.

- Deduct Cost of Goods Sold: Calculate the cost of goods sold to find the gross profit. This is the direct cost associated with producing the goods or services you sell. Subtract it from your revenue to determine the gross profit.

- Categorize Operating Expenses: Categorize your operating expenses, including rent, utilities, salaries, marketing costs, and any other expenses necessary to run your business. Include them in your profit and loss statement.

- Calculate Operating Income: Subtract the total operating expenses from the gross profit to find the operating income. This reflects how profitable your core business operations are.

- Include Non-Operating Income: If your business has any non-operating income, such as interest income or gains from investments, include it in your statement.

- Calculate Interest, Taxes, Depreciation, and Amortization: Factor in any interest expenses, taxes, depreciation, and amortization in your profit and loss statement.

- Calculate Net Income: Finally, subtract the total of interest, taxes, depreciation, and amortization from the operating income to calculate the net income. This represents the overall profitability of your business.

Once you’ve completed these steps, you’ll have a comprehensive profit and loss statement that provides insights into the financial performance and profitability of your small business.

Vertical Analysis of Profit and Loss Statement

Vertical analysis is a useful technique to assess the relative proportions of different line items in the profit and loss statement. By expressing each line item as a percentage of revenue or net sales, you can identify areas of concern and evaluate their impact on profitability.

For example, if the cost of goods sold has significantly increased as a percentage of revenue, it may indicate inefficiencies in your production process or increased material costs. On the other hand, if operating expenses have decreased as a percentage of revenue, it suggests cost-saving measures and improved efficiency.

Performing vertical analysis allows you to compare financial data across different periods and identify trends in your small business’s profitability. It provides valuable insights into the financial health of your business and helps you make informed decisions to optimize performance.

Example of Profit and Loss Statement for Small Business

| Revenue | £100,000 |

|---|---|

| Cost of Goods Sold | £40,000 |

| Gross Profit | £60,000 |

| Operating Expenses | £30,000 |

| Operating Income | £30,000 |

| Non-Operating Income | £5,000 |

| Interest, Taxes, Depreciation, and Amortization | £10,000 |

| Net Income | £25,000 |

Interpreting a Profit and Loss Statement

Interpreting a profit and loss statement involves analyzing various financial metrics and line items. The profit and loss statement, also known as the income statement or P&L statement, is a key financial statement that provides a snapshot of a company’s financial performance over a specific period of time.

The profit and loss statement starts with the sales revenue, which represents the total income generated by the company from its core operations. This includes revenue from the sale of products or services. It is important to note that this figure represents the company’s top-line revenue before deducting any expenses.

The next important element of the profit and loss statement is the cost of goods sold (COGS), which reflects the direct expenses associated with the production of goods or delivery of services. These expenses include raw materials, direct labor costs, and manufacturing overheads. Subtracting the COGS from the sales revenue gives the company’s gross profit.

After determining the gross profit, the next step is to deduct the operating expenses. These expenses include sales and marketing costs, research and development expenses, general and administrative expenses, and other operating costs. Subtracting these expenses from the gross profit gives the operating income or operating profit.

Non-operating income such as interest income, investment gains, and other sources of income are also taken into account in the profit and loss statement. On the other hand, expenses like interest expenses, taxes, depreciation, and amortization are also considered, as they can have an impact on the company’s overall profitability.

A profit and loss statement provides valuable insights into the company’s profitability. Key metrics such as the gross profit margin and net profit margin indicate the efficiency of the company’s operations and its ability to generate profits. These metrics can be compared over time to track the company’s performance and identify areas for improvement.

“The profit and loss statement is an essential financial statement that allows businesses to assess their financial performance and make informed decisions. By analyzing the various line items and metrics in the statement, companies can gain insights into their revenue, expenses, and overall profitability.”

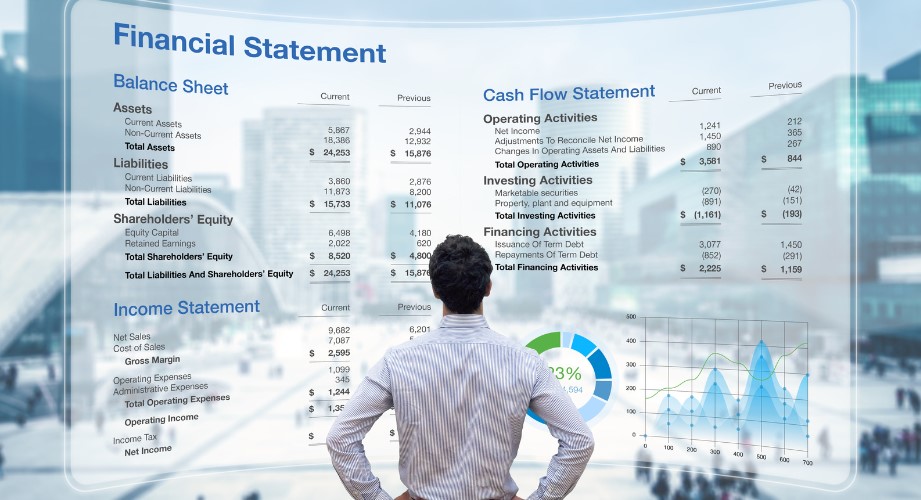

Comparing the profit and loss statement with other financial statements such as the balance sheet and cash flow statement can provide a comprehensive view of the company’s financial health and enable better financial analysis and planning.

Using a Profit and Loss Statement for Financial Analysis

A profit and loss statement is a powerful tool for financial analysis. It allows businesses to evaluate their financial health, monitor growth, and identify areas for improvement. By analyzing sales trends, cost of goods sold, and operating expenses, companies can make informed decisions to optimize profitability.

One important aspect of financial analysis is examining the earnings statement, which outlines the revenue and expenses of a business. This statement provides valuable insights into the company’s financial performance and helps in assessing its overall profitability.

Another crucial component is the operating statement, which focuses on the core operations of the business. It provides an in-depth analysis of the company’s operating revenues and operating expenses. By examining this statement, businesses can identify any inefficiencies in their operations and take appropriate measures to improve performance.

Utilizing ratios and metrics derived from the profit and loss statement enhances financial analysis. For example, calculating the gross profit margin helps determine the profitability of each unit sold. The operating profit margin helps assess the efficiency of a company’s operations, while return on investment measures the profitability of investments made.

“The profit and loss statement is a vital tool for financial analysis. It provides a comprehensive view of a business’s financial performance, allowing business owners to make informed decisions and take corrective actions to achieve their financial goals.”

Financial Analysis Metrics

When conducting financial analysis using a profit and loss statement, several key metrics can help gain meaningful insights:

- Gross Profit Margin: This ratio indicates the profitability of each unit sold, calculated by dividing gross profit by revenue.

- Operating Profit Margin: This ratio measures the profitability of a company’s core operations, calculated by dividing operating income by revenue.

- Net Profit Margin: This ratio represents the overall profitability of the business, calculated by dividing net income by revenue.

- Return on Investment (ROI): This ratio evaluates the profitability of investments made by the company, calculated by dividing net income by total assets.

By analyzing these metrics and comparing them over time, businesses can identify trends, uncover strengths, and address weaknesses. These insights enable business owners to make data-driven decisions and implement strategies that lead to long-term success.

| Financial Metric | Calculation | Interpretation |

|---|---|---|

| Gross Profit Margin | Gross Profit / Revenue | Measures the profitability of each unit sold |

| Operating Profit Margin | Operating Income / Revenue | Assesses the profitability of core operations |

| Net Profit Margin | Net Income / Revenue | Represents the overall profitability of the business |

| Return on Investment (ROI) | Net Income / Total Assets | Evaluates the profitability of investments made by the company |

Using a profit and loss statement for financial analysis equips businesses with valuable insights and helps drive informed decision-making. By examining the earnings statement and operating statement, along with key metrics, businesses can optimize profitability, address financial challenges, and enhance their overall financial health.

Conclusion

In conclusion, preparing a statement of profit and loss is essential for startups to assess their financial status and monitor growth. By following the necessary steps and utilizing templates or financial management software, businesses can easily generate this statement.

Interpreting the profit and loss statement allows for a deeper understanding of the company’s financial position and performance. It is important to use this statement for financial analysis, including assessing profitability, identifying trends, and making informed decisions.

Alongside a balance sheet and cash flow statement, a profit and loss statement provides valuable insights into a company’s financial health and is vital for sustained business growth. To prepare a cash flow statement from a balance sheet, businesses can analyze the changes in cash and cash equivalents and incorporate operating, investing, and financing activities.

Ultimately, by effectively utilizing financial statements such as the statement of profit and loss, businesses can gain a comprehensive understanding of their financial performance and make strategic decisions to drive success.

FAQ

What is a statement of profit and loss?

A statement of profit and loss, also known as an income statement, is a primary financial statement used by small business owners to assess their financial status. It analyzes a company’s expenses and revenue to determine its net income.

Why is a profit and loss statement important for startups?

A profit and loss statement is crucial for startup companies as it helps monitor growth, profitability, and identify damaging business practices.

How does a profit and loss statement help with financial analysis?

A profit and loss statement provides valuable information for financial analysis, including assessing profitability, identifying trends, and making informed decisions.

What is the purpose of a profit and loss statement?

The purpose of a profit and loss statement is to provide a comprehensive overview of a company’s financial health by evaluating its profitability and growth.